71%

of employees are financially stressed

Employees are loosing 1 day of week

(i.e. 2 months a year!) to financial ANXIETY

45%

of people live paycheck-to-paycheck

EMPLOYEES DON’T NEED ANOTHER INVESTMENT COURSE, THEY NEED IMPARTIAL MODERN FINANCIAL EDUCATION TO IMPROVE THEIR OVERALL FINANCIAL HEALTH

Improving Employee Engagement and Retention

Enhancing Employee Well-Being

Boosting Productivity and Performance

Measure Your Employees’ Financial Health

With just 20 questions, you get an aggregated score that highlights strengths and areas for improvement, helping you tailor financial wellness initiatives that truly meet your employees’ needs.

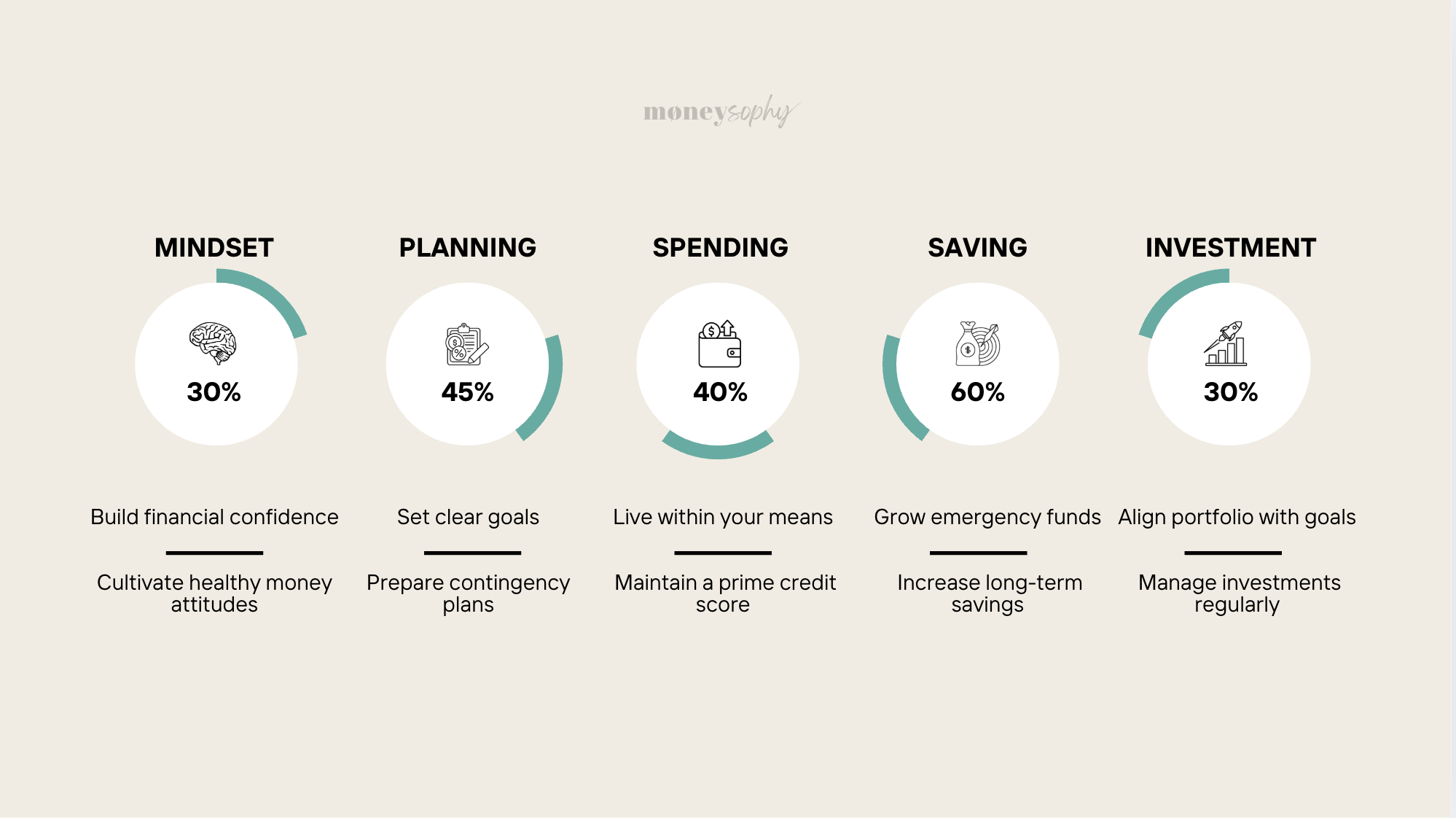

The Financial Health Score is a simple yet powerful tool that measures your employees’ financial wellbeing across five key areas:

Benefits of Measuring Financial Health

Traditional metrics often focus narrowly on investments, but a comprehensive view of your employees’ entire financial picture is essential for meaningful support.

The statistics speak for themselves: 71% of employees experience financial stress, losing about one full day of work each week (equivalent to two months per year) due to financial anxiety, and 45% live paycheck-to-paycheck.

By assessing employees’ financial health score, organisations can gain clear insights to develop impactful products and services, enabling you to identify real financial needs, design targeted financial wellness programmes, and track progress to measure effectiveness, including delivering business benefits.

IMPARTIAL MODERN FINANCIAL EDUCATION COMES IN MANY FORMS…

Interactive Presentations

to raise awareness among the general public

70% Presentation

and 30% Engagement-related Activities

Training Workshops

to actively reflect, take action and leverage collective intelligence

30% Presentation

and 70% Engagement-related Activities

Individual CONSULTATION

to get personalised advice and accountability followups in all confidentiality

Financial wellness is a corporate matter!

Let’s work together, shall we?